Earn More From Your Everyday Spend

Extraordinary Benefits from Everyday Spend

Maximize your credit card rewards, cash back, and benefits.

We've helped our members earn $500 Million+ in rewards in the last 12 months

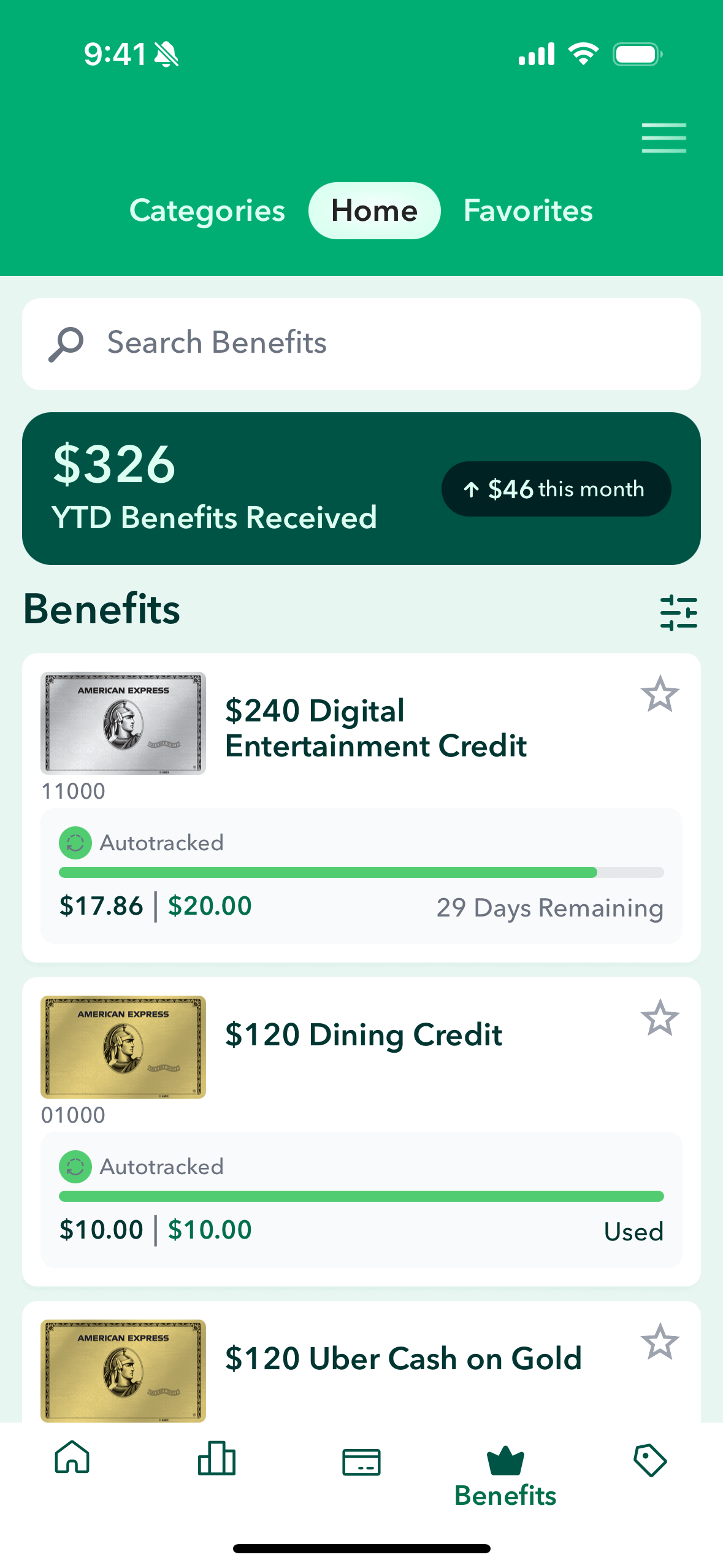

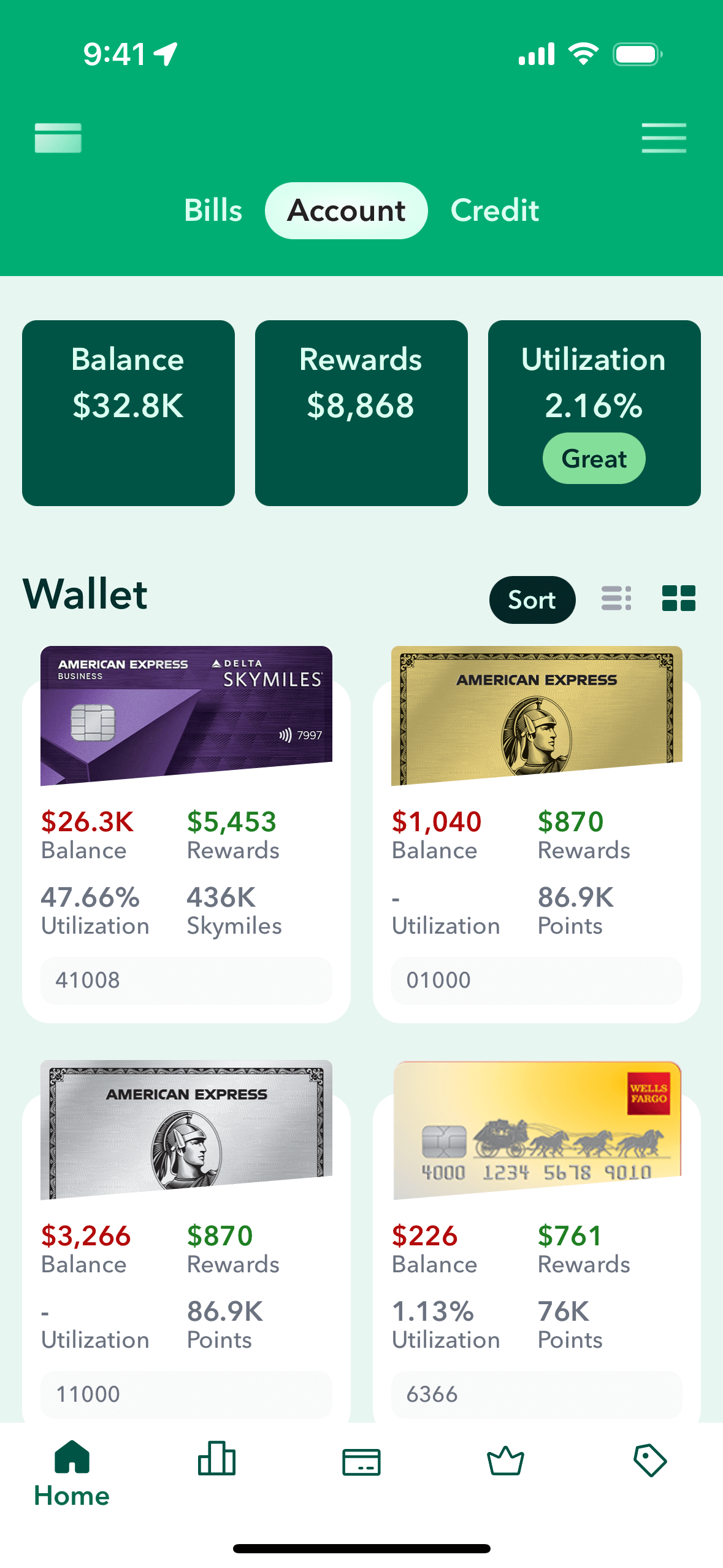

Wallet

Aggregation

Enjoy Managing All Your Accounts With Confidence

Connect all your accounts to get a clear view of your finances, save time, and maximize your benefits.

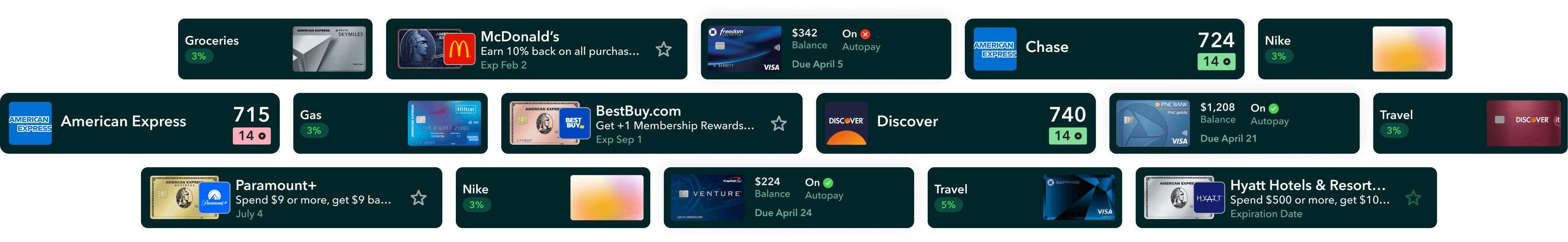

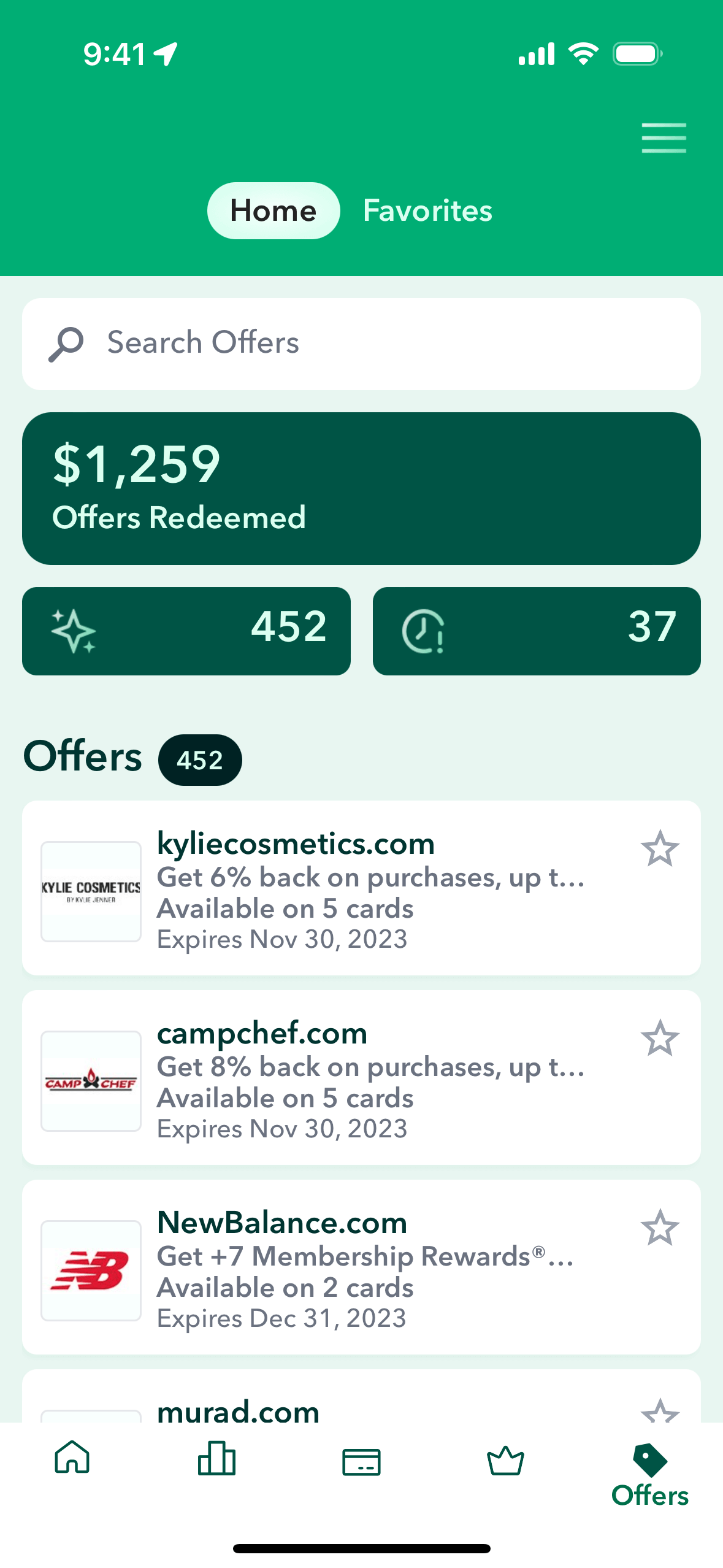

Offer Automation

Maximize Your Earning Potential

Automatically Activate Thousands In Offers And Benefits Instantly

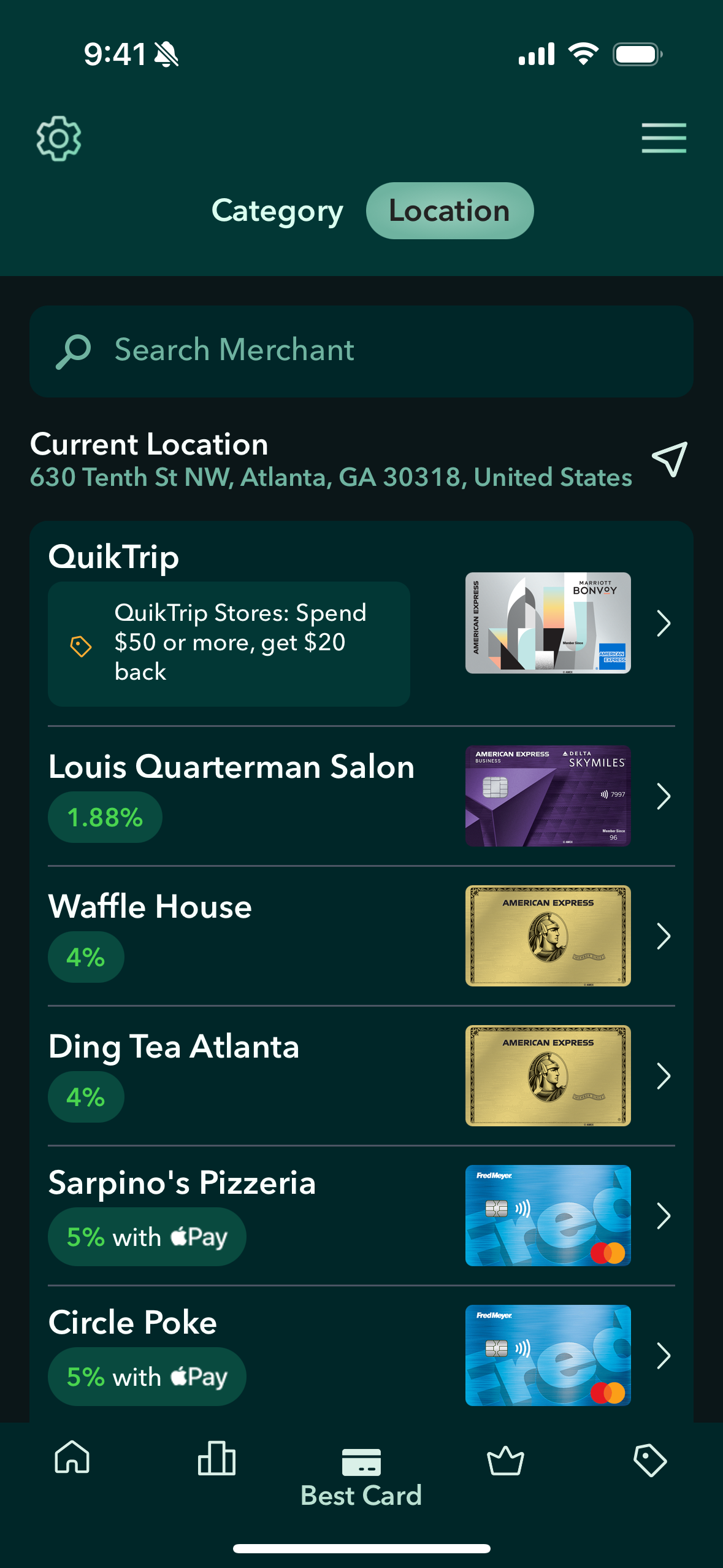

Best Card

Easily See What Card Is Best

MaxRewards calculates point valuations, cashback offers and reward bonuses to intelligently recommend the Best Card for nearby merchants so you never miss an opportunity to earn

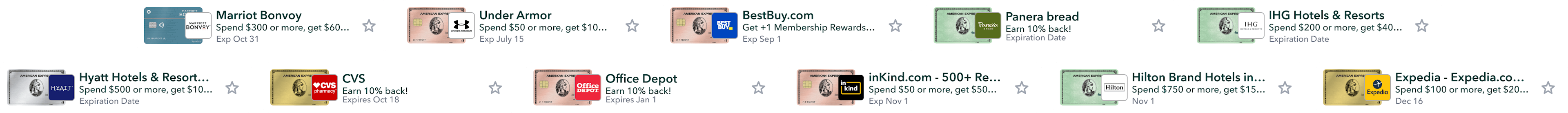

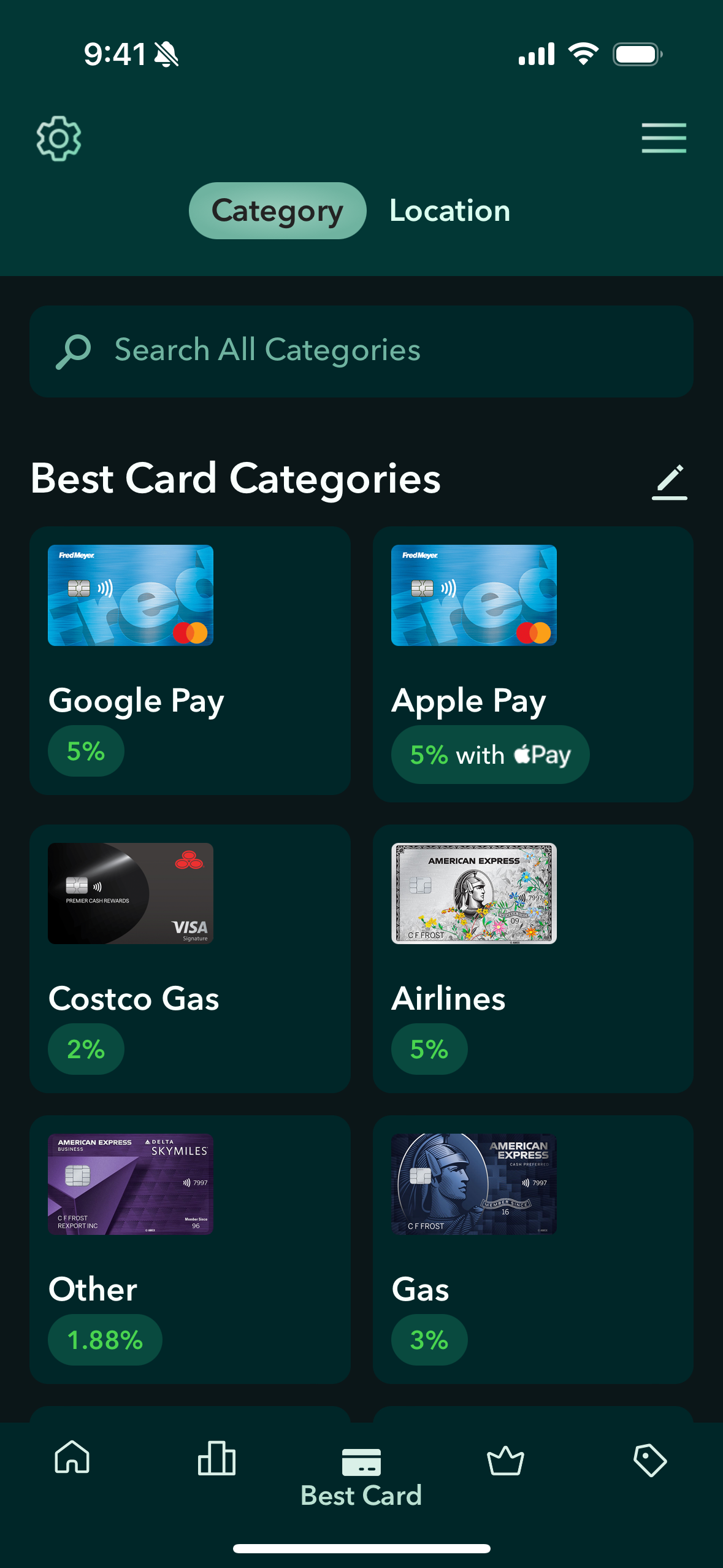

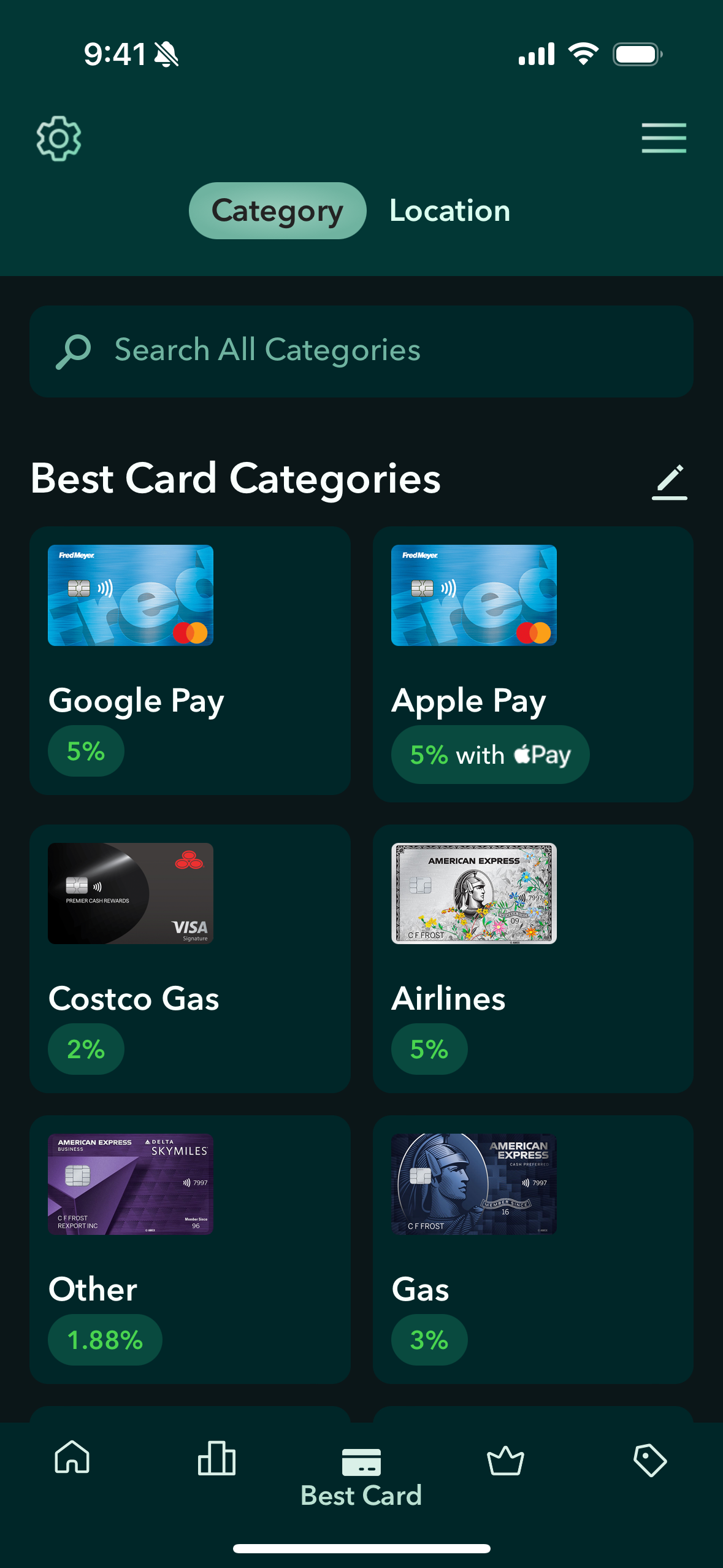

Best Card

See The Best Card By Category

Discover the best card for every purchase category and popular merchants

Kroger

6.00%

Kroger

6.00%

Kroger

2.25%

Marriott

4.20%

Marriott

3.75%

Marriott

3.75%

Walgreens

3.75%

Walgreens

2.25%

Walgreens

2.00%

Exxon

6.25%

Exxon

5.00%

Exxon

4.00%

Netflix

6.00%

Netflix

3.75%

Netflix

3.00%

Target

5.00%

Target

2.25%

Target

2.00%

T-Mobile

3.75%

T-Mobile

3.00%

T-Mobile

2.25%

Macy's

2.25%

Macy's

2.00%

Macy's

2.00%

United Air

7.50%

United Air

4.50%

United Air

3.75%

Grubhub

6.00%

Grubhub

3.75%

Grubhub

3.75%

Fandango

6.25%

Fandango

2.25%

Fandango

2.00%

Hertz

3.75%

Hertz

3.75%

Hertz

3.00%

MaxRewards is helping members with their 1.3 Million cards

Security & Privacy

Your Data Privacy is Our Top Priority

We use bank-level encryption

We never access credit card or social security numbers

We won't sell your data

Trusted by over

400,000 Members

4.6 Stars (10k Ratings)

This app helps me decide which cards to use on different places and helps me save.

I’ve been looking for something like this for so long. So simple to use, and SUPER helpful to know which card to use. This WILL change your life.

This Application is an amazing tool and is my go to before I purchase flights, groceries, entertainment etc... It’s helped me optimize all my purchases and I’m super excited to save even more. Well done MaxRewards!

I love how I can track everything on this app!! Sometimes I have to sync it but it's just a one click and shows everything about my credit cards including balance, rewards, and even Utilization rate. Highly recommend

First time using the app. This app is make life so much easier to manage my cards and finances. Very User friendly

Once you get everything registered it is 10x easier to look at all the information regarding your cards in one place.

Everything from Credit Management to Which card will maximize cash-back Rewards at local store, to be honest... hands down, this is the best App for Credit Enthusiasts and Organized Minimalist’s. I’m not even Sponsored (Should be!) I just call it how it is. Even if you feel like you don't like something about the app, just communicate that to their Customers Services and they “No lie” will look into improving the issue. Just Downloaded it and thank me later!

Greatest of all time app and I mean it! I usually don’t care for apps and I don’t review apps because I believe all apps should be at least decent (don’t believing in praising apps for doing what they should) but this app has blown me out of the water!! What an amazing concept, extremely helpful, easy to use (esp for non finance inclined people like myself, and so many features!!!! And all for free! Great innovative app that helps with not only financial literacy but health as well

I’m a credit card geek. My parents are planning a trip to Europe, so I got them a set of credit cards to use to maximize free travel when that trip happens. However, they have a hard time remembering when and where to use each card…This is exactly what I was looking for. When my parents approach a store, they can incredibly quickly see what card to use at each store. What’s even cooler is that the average point valuation can affect the rewards rate, so travel cards can go hand-and-hand with cash back cards. Get this app. It’s definitely a must have… You need this app.

Great app. So convenient to have a bird’s eye view of all cards in one place rather than accessing them all individually. The utilization breakdown is helpful as well.

I absolutely love that I can manage all my cards / rewards under a single app! Also I love the SUB monitoring, something Amex lacks. Great job dev team.

I love this app!!!! My personal credit card organizer and more. Easy to read an use!!!!

I just installed this app but am quite pleased with how easy it is to add cards to my account and the simple format which it displays all my information. I like it

For a reward enthusiast like myself, this app is invaluable. I really thought I was getting the most points through my own strategies. But little did I know, I’ve been missing out. The app also does so much more. I love it.

Best app for staying on top of my credit cards. User interface is very intuitive. The app keeps getting better every month.

Best app to track my spend, rewards, and credit scores! Didn’t even know I had different scores at every bank! Love the Best Card to Use feature!

Very easy to track all spending and sign up bonus requirements in one place. Shows category best cards in one place. Must have app for anyone with 3+ cards. Unpaid version also beats many paid apps.

This app helps me decide which cards to use on different places and helps me save.

I’ve been looking for something like this for so long. So simple to use, and SUPER helpful to know which card to use. This WILL change your life.

This Application is an amazing tool and is my go to before I purchase flights, groceries, entertainment etc... It’s helped me optimize all my purchases and I’m super excited to save even more. Well done MaxRewards!

I love how I can track everything on this app!! Sometimes I have to sync it but it's just a one click and shows everything about my credit cards including balance, rewards, and even Utilization rate. Highly recommend

First time using the app. This app is make life so much easier to manage my cards and finances. Very User friendly

Once you get everything registered it is 10x easier to look at all the information regarding your cards in one place.

Everything from Credit Management to Which card will maximize cash-back Rewards at local store, to be honest... hands down, this is the best App for Credit Enthusiasts and Organized Minimalist’s. I’m not even Sponsored (Should be!) I just call it how it is. Even if you feel like you don't like something about the app, just communicate that to their Customers Services and they “No lie” will look into improving the issue. Just Downloaded it and thank me later!

Greatest of all time app and I mean it! I usually don’t care for apps and I don’t review apps because I believe all apps should be at least decent (don’t believing in praising apps for doing what they should) but this app has blown me out of the water!! What an amazing concept, extremely helpful, easy to use (esp for non finance inclined people like myself, and so many features!!!! And all for free! Great innovative app that helps with not only financial literacy but health as well

I’m a credit card geek. My parents are planning a trip to Europe, so I got them a set of credit cards to use to maximize free travel when that trip happens. However, they have a hard time remembering when and where to use each card…This is exactly what I was looking for. When my parents approach a store, they can incredibly quickly see what card to use at each store. What’s even cooler is that the average point valuation can affect the rewards rate, so travel cards can go hand-and-hand with cash back cards. Get this app. It’s definitely a must have… You need this app.

Great app. So convenient to have a bird’s eye view of all cards in one place rather than accessing them all individually. The utilization breakdown is helpful as well.

I absolutely love that I can manage all my cards / rewards under a single app! Also I love the SUB monitoring, something Amex lacks. Great job dev team.

I love this app!!!! My personal credit card organizer and more. Easy to read an use!!!!

I just installed this app but am quite pleased with how easy it is to add cards to my account and the simple format which it displays all my information. I like it

For a reward enthusiast like myself, this app is invaluable. I really thought I was getting the most points through my own strategies. But little did I know, I’ve been missing out. The app also does so much more. I love it.

Best app for staying on top of my credit cards. User interface is very intuitive. The app keeps getting better every month.

Unlock the potential of every financial decision